-

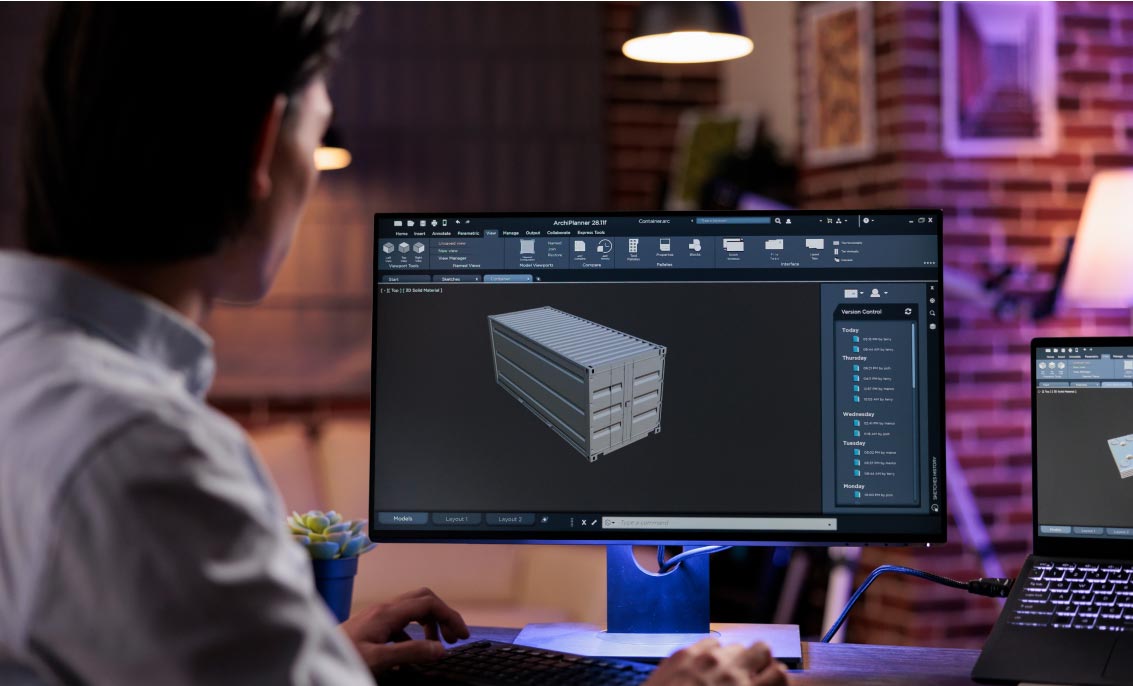

Navigating the Future of ERP Software Implementation with Consulting 2.0

Explore Posts by Topic:

Business Agility

-

When and How to Use an Independent Consulting Marketplace

Read Post : When and How to Use an Independent Consulting Marketplace -

Maintaining Strategic Resiliency: Key Learnings from the Executive Strategy Forum

Read Post : Maintaining Strategic Resiliency: Key Learnings from the Executive Strategy Forum -

The Advantages of Fractional Talent and Interim Support

Read Post : The Advantages of Fractional Talent and Interim Support

Consulting

-

Why Every Consulting Firm Needs a Virtual Talent Bench

Read More : Why Every Consulting Firm Needs a Virtual Talent Bench -

How an Independent Consultant Went from $0 Bottom Line to $500K in One Year on Catalant

Read More : How an Independent Consultant Went from $0 Bottom Line to $500K in One Year on Catalant -

Expert Perspectives: How Independent Consultants Help You Stay Honest and On Budget

Read More : Expert Perspectives: How Independent Consultants Help You Stay Honest and On Budget

Featured Report

Catalant Quarterly, Issue 1

Hear directly from some of the most talented AI consultants on the Catalant platform about how to strategically approach and implement new AI initiatives.

Private Equity

-

Consulting 2.0: The Optimal Solution for Right-Sized Commercial Due Diligence and Post Merger Integration in Add-On Deals

Read More : Consulting 2.0: The Optimal Solution for Right-Sized Commercial Due Diligence and Post Merger Integration in Add-On Deals -

FP&A Investment During the Private Equity Deal Cycle

Read More : FP&A Investment During the Private Equity Deal Cycle -

Carve-out Consultants for Private Equity

Read More : Carve-out Consultants for Private Equity

Corporate Strategy

-

Expert Perspectives: Executing Diligence in a Competitive and Selective Environment

Read More : Expert Perspectives: Executing Diligence in a Competitive and Selective Environment -

The Ultimate Guide to Corporate Strategy

Read More : The Ultimate Guide to Corporate Strategy -

4 Mantras for Successful Strategic Execution Today

Read More : 4 Mantras for Successful Strategic Execution Today

The Future of Work

-

Leading through Uncertainty: Key Learnings from Catalant’s Executive Strategy Session

Read More : Leading through Uncertainty: Key Learnings from Catalant’s Executive Strategy Session -

What is the Future of Work? An Ultimate Guide

Read More : What is the Future of Work? An Ultimate Guide -

Understanding the New Rules of Work With Joe Fuller

Read More : Understanding the New Rules of Work With Joe Fuller

Want insights delivered directly to your inbox?

Subscribe to our monthly newsletter to stay ahead of the curve.

Operational Efficiency

-

Warehouse Worker Shortage Is Fueling Robotics Explosion

Read More : Warehouse Worker Shortage Is Fueling Robotics Explosion -

The Future of Supply Chain: How to automate purchase orders and optimize your supply chain

Read More : The Future of Supply Chain: How to automate purchase orders and optimize your supply chain -

Expert Perspectives: How to Optimize Inventory Management

Read More : Expert Perspectives: How to Optimize Inventory Management

Digital Transformation

-

How to Implement Generative AI In Your Business

Read More : How to Implement Generative AI In Your Business -

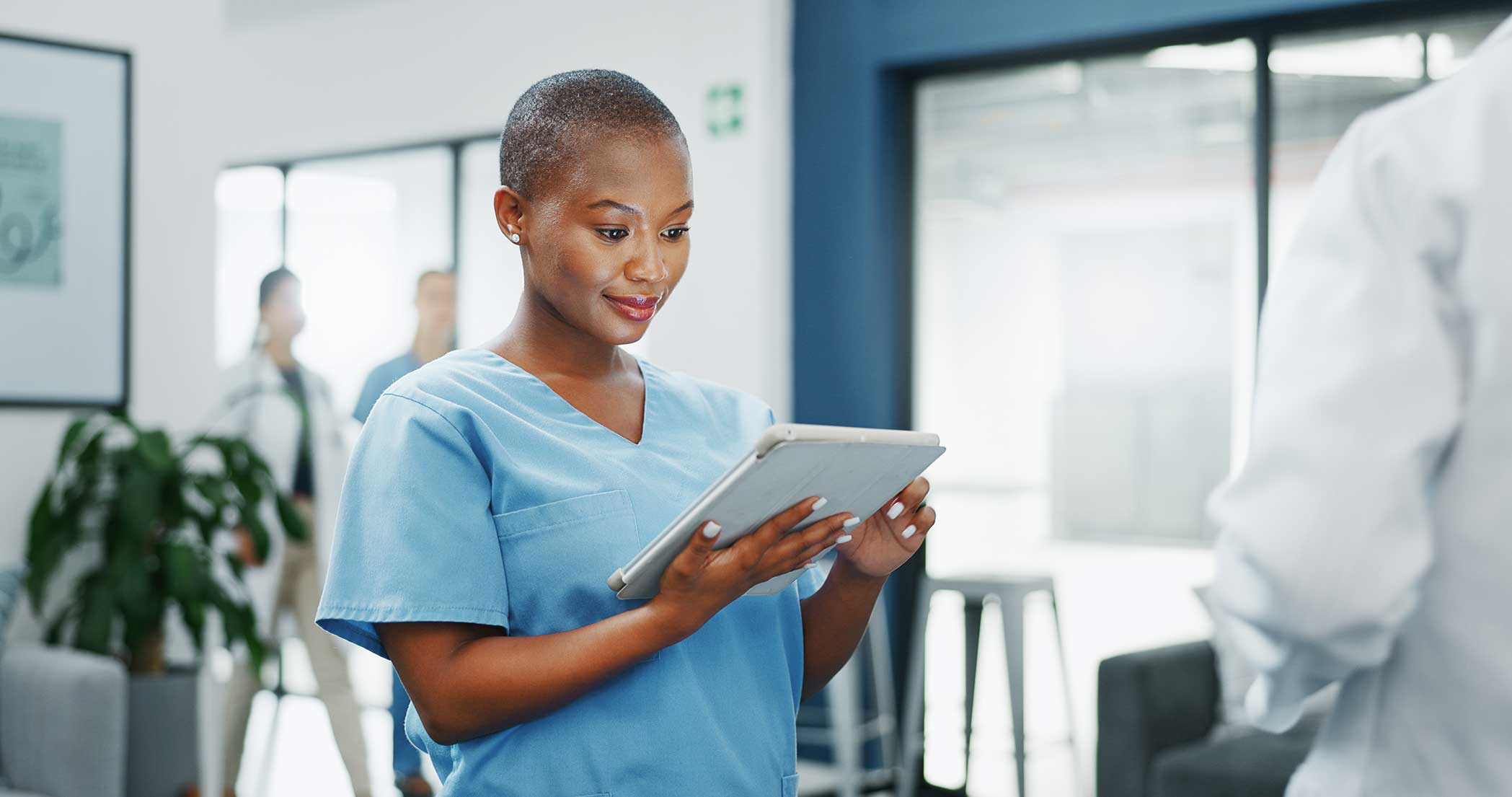

5 Things to Get Right When Planning a Digital Transformation in Healthcare

Read More : 5 Things to Get Right When Planning a Digital Transformation in Healthcare -

What Is Digital Transformation? Everything You Need to Know

Read More : What Is Digital Transformation? Everything You Need to Know

Go-To-Market Strategy

-

How CPG and Retail Businesses Can Adopt Practical Data-Driven Marketing Strategies

Read More : How CPG and Retail Businesses Can Adopt Practical Data-Driven Marketing Strategies -

The Ultimate Guide to a Successful Go-to-Market Strategy [+Examples]

Read More : The Ultimate Guide to a Successful Go-to-Market Strategy [+Examples] -

4 Catalant Experts Improve Marketing ROI For Clients

Read More : 4 Catalant Experts Improve Marketing ROI For Clients